Youth Accounts

Prepare For The Future

Youth-oriented accounts are perfect for high school and college students looking to build savings, and for parents teaching budgeting and smart spending

All Wheelhouse Accounts Include

-

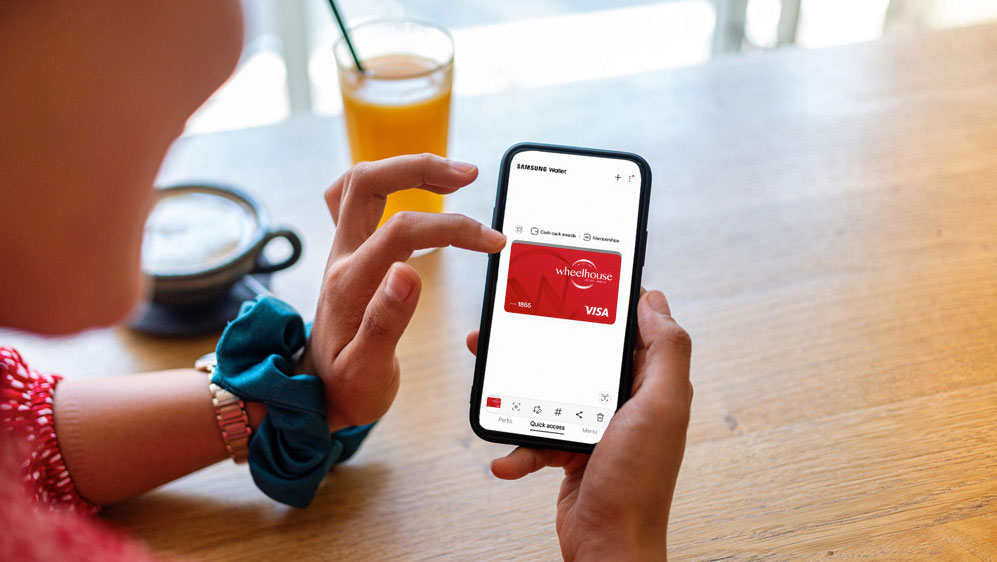

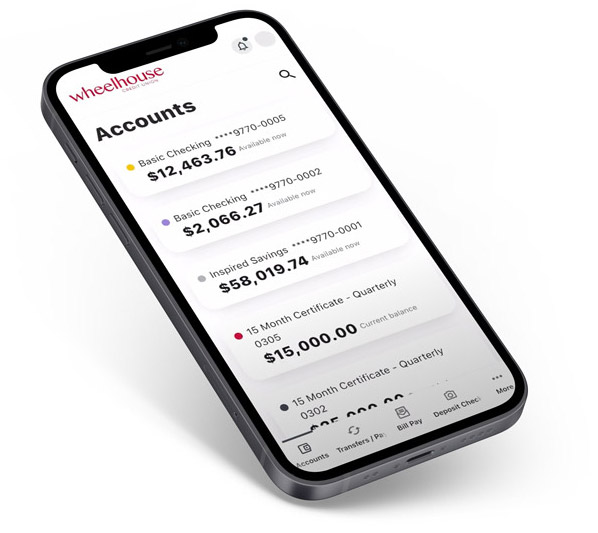

Do it all with 24/7 Digital Banking

Pay bills, deposit checks, send money, and manage your digital wallet all in the Wheelhouse app.

-

Stress-Free Courtesy Pay Available

Automatic transfer of funds from your designated account(s) if you don't have sufficient funds.

-

Security You Can Count On

Use multi-factor authentication and integrated device security such as fingerprint and facial recognition to access your accounts.

-

Send and receive money – no extra app needed

Use Zelle® for a fast, safe, and easy way to pay your friends and family.

-

Debit Rewards1

Earn 1 reward point for each $3 spent with your Visa® Debit Card.

Access Checking2

Help them establish financial independence

With a minimum age of 16, Access Checking offers free Digital Banking, Bill Pay (for 18+), and eStatements with no monthly service charge. Use your Wheelhouse® Visa® Debit Card to earn debit rewards points. Overdraft Services available.

- No Monthly Requirements

- Earn Debit Rewards1

Aspire Savings3

Build a foundation for their financial future

Our savings account caters specifically to members aged 13-26, offering competitive rates equivalent to our Regular Share Savings, while eliminating fees for inactivity. Ideal for both short-term and long-term savings goals. 24/7 account access via the Wheelhouse Digital Banking app.

- No Monthly Requirements

- Earn 1.00% APY* with no minimum balance required

Coverdell Education Savings

Save for a brighter future

The Coverdell Education Savings Account is for the specific purpose of assisting with the cost of your child’s education. Although a savings account, it’s similar to an Individual Retirement Account or Certificate Account.

- No monthly service charges

- Earn dividends on balances of $25 or more

- Must be established before the child’s 18th birthday

- Funds must be used prior to the child turning 30 years old

Wheelhouse College Scholarship Programs

Our Badge of Honor College and Sustainability College Scholarships are two distinct college scholarship programs that recognize and reward exceptional San Diego students who demonstrate traits of leadership, a commitment to public service and a desire to make a positive impact on their communities.

“Getting my first checking account feels amazing! I can finally manage my own money and see everything in one place. I love the independence it gives me!”

- Sienna

“Watching them learn how to manage their own money is truly rewarding and gives me confidence that they’re on the right track for their future.”

- Scott

Wheelhouse is Committed To Giving Back

Our team is actively involved in the community throughout the year, and we’re proud to support a wide variety of organizations and efforts that have a positive impact on our beautiful City.

Financial Literacy Fundamentals

Learning these basics, individuals can make informed decisions and work toward financial goals, ensuring a secure and prosperous future.

-

1

Using a Checking Account

Learn to open and set up an account, write checks, use a debit card, set up direct deposit, and manage the account online or via a mobile app. -

2

Managing Balances and Avoiding Fees

Keep track of transactions, read bank statements, maintain a sufficient balance, avoid overdraft fees, and understand account fees. -

3

Security and Fraud Prevention

Protect personal and financial information, safeguard debit card details, recognize phishing scams, use strong passwords and two-factor authentication, and monitor account activity for suspicious transactions.

Ready to open a Wheelhouse Account?

Disclosures

* APY = Annual Percentage Yield. Rates are effective as of 03/01/2025 and are subject to change without notice.

1Debit Reward points are earned each time you use your Wheelhouse Credit Union Visa® Debit Card on qualifying Non-PIN based POS transactions. Qualifying Non-PIN based POS transactions include debit transactions, contactless payments, card swipes, and signature-based transactions. Cash advances and ATM transactions are not considered qualifying transactions. All reward points will post to your account upon verification of qualifying transactions. For every qualified three dollars ($3.00) charged to the cardholder’s enrolled debit card, you will earn one (1) reward point. Plus, earn additional points throughout the year on qualifying categories. Log in to Digital Banking to view and redeem points. For a complete list of qualifying categories, visit WheelhouseCU.com/BonusRewards. Contact the Cards & Operations Department at (619) 297-4835 with disputes regarding qualifying transactions.

2Access Checking is designed for members ages 16 to 25 and requires an initial minimum deposit of $25. Upon turning 26, the Access Checking account will automatically convert to a Basic Checking account. For members under 18, Access Checking accounts require an adult joint account holder. Contact a Wheelhouse representative for more information.

3Aspire Savings is designed exclusively for members ages 13 to 25. No initial minimum deposit is required. Upon turning 26, the Aspire Savings account will automatically convert to a Regular Shares account. For members under 18, Aspire Savings accounts require an adult joint account holder. Contact a Wheelhouse representative for more information.

Other terms, conditions, and restrictions may apply. Membership is required. Federally insured by NCUA.

©2025 Wheelhouse Credit Union.