Checking Accounts

Smart Banking Starts Here

Our competitive rates and perks let you choose the checking account that fits your needs.

All Wheelhouse Checking Accounts Include

-

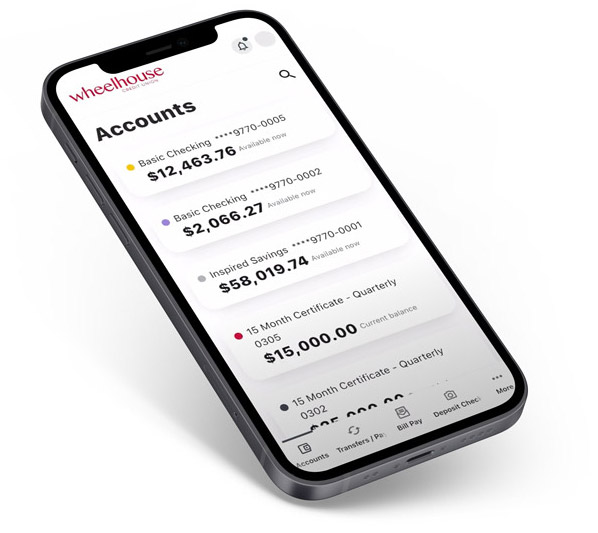

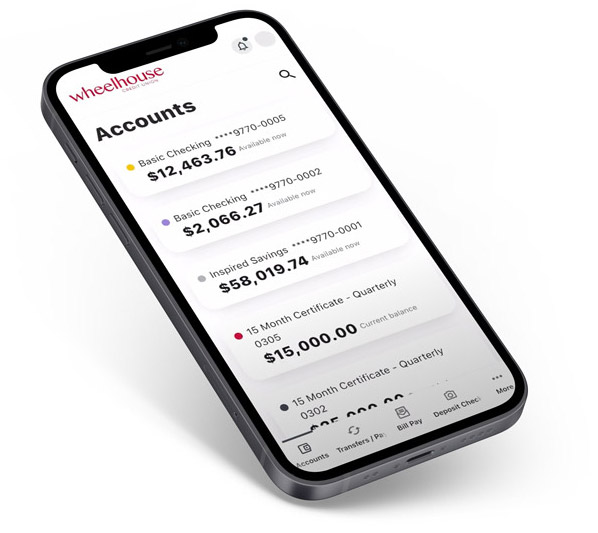

Do it all with 24/7 Digital Banking

Pay bills, deposit checks, send money, and manage your digital wallet all in the Wheelhouse app.

-

Stress-Free Courtesy Pay3 Available

Automatic transfer of funds from your designated account(s) if you don't have sufficient funds.

-

Security You Can Count On

Use multi-factor authentication and integrated device security such as fingerprint and facial recognition to access your accounts.

-

Send and receive money - no extra app needed

Use Zelle® for a fast, safe, and easy way to pay your friends and family.

-

Debit Rewards1

Earn 1 reward point for each $3 spent with your Wheelhouse® Visa® Debit Card.

Start Earning Reward Points1

When it comes to rewards, we do them right. With NO Annual Fee, you can combine Debit and Credit Card points and redeem your reward points into whatever options make the most sense for you.

-

2x points on Select Transactions

Travel: Airlines, Car Rentals, Hotels, Cruise Lines and more (June - August)

Retail: Telephone, Cable and other pay television, Electric, Gas and Water (October - December) -

Get 5x points per $1 Spent

Earn bonus points from national, regional and local Restaurants, and Retailers.

-

Earn Cash Back

Get $9.99 – $25 back on your next purchase at select Sam’s Clubs, Dropbox, Grubhub, and more in-store and online retailers.

No minimums,

no worries.

Get your account up and running in minutes.

-

1

Tell us about yourself.

Answer a few quick questions to get you started. -

2

Add money to your account.

As soon as you deposit or transfer funds you’ll earn interest. No minimum deposit required. -

3

Start your journey

Activate your savings by downloading the Inspired Perks app.

Wheelhouse® is Committed To Giving Back

Our team is actively involved in the community throughout the year, and we’re proud to support a wide variety of organizations and efforts that have a positive impact on our beautiful City.

Ready to open a Wheelhouse Account?

Disclosures

1 Earn Debit Reward points each time you use your Wheelhouse® Visa® Debit Card on qualifying non-PIN based point-of-sale (POS) transactions. Qualifying non-PIN based POS transactions include debit transactions, contactless payments, card swipes, and signature-based transactions. Cash advances and ATM transactions are not considered qualifying transactions. All reward points will post to your account once qualifying transactions are verified. For every verified $3.00 spent using your Wheelhouse® Visa® debit card, you will earn one reward point. Plus, earn additional points throughout the year on qualifying categories. Log in to Digital Banking to view and redeem points. For a complete list of qualifying categories, visit WheelhouseCU.com/BonusRewards. Contact the Cards & Operations Department at (619)297-4835 with questions or disputes regarding qualifying transactions.

2 APY = Annual Percentage Yield. Rates are effective as of 05/17/2024 and are subject to change without notice. To receive the APY of 3.00%, you must make a minimum of 20 qualifying purchase transactions using your Wheelhouse® Visa® Debit Card associated with an Inspired Plus Checking account per calendar month and/or maintain an average daily balance of $75,000 or higher. No minimum balance is required to earn dividends. Inspired Plus Checking is a variable rate account. The APY may change after account opening.

APY is accurate as of the last dividend declaration date. Fees could reduce earnings on the account. Inspired Plus Checking requires an initial minimum deposit of $10, monthly direct deposits totaling $450 or more, an active digital banking registration, and eStatements within 90 days of account opening, plus a monthly fee of $9.00. If requirements are not met and maintained, the account will be converted to a Basic Checking Account which may be subject to different terms, conditions, and restrictions and access to Perks by Wheelhouse® will be removed.

3 We recognize that sometimes you may overdraw your checking account. In such cases we may decide to honor items for which there are insufficient funds. This is our Bounce Guard program. We provide the Bounce Guard program as an accommodation to you and are not obligated to do so, even if we have done so in the past. You do not apply for this service. Bounce Guard has a limit of $750. Bounce Guard is not available on Access/Youth Checking Accounts. See the Credit Union’s Fee Schedule for fees associated with Bounce Guard (subject to change).

Qualification: To be eligible for the Bounce Guard Program, you must be a member in good standing and not have a negative record with a credit reporting agency.

Description of Service: By participating in the program, we may honor overdrafts including:

- Checks

- ACH debits

- ATM transactions and point of sale (POS)transactions; Recurring Debit Card transactions and

- One-time Debit Card transactions

Unless we currently have your affirmative consent (opt-in) on file, we will not approve your overdrafts for ATM/POS and one-time Debit card transactions. You must tell us you want overdraft coverage for these transactions. To request overdraft coverage for ATM and one-time Debit card transactions, contact us at 619.297.4835 or write to us at P.O. Box 719099, San Diego, CA 92171-9099, or complete and sign the Enrollment Form provided to you at account opening or upon request. Return the form to any branch location or mail it to us at the address shown above. We will provide you with written confirmation of your affirmative consent.

When an overdraft is covered, the account will be taken negative by the dollar amount of the transaction plus the amount of the Bounce Guard fee stated on the Fee Schedule. If we honor multiple overdrafts, we may honor them in any order in our sole discretion or return any such items. The Bounce Guard overdraft service is available to qualified members maintaining a Basic Checking Account, an Inspired Checking Account, a Dividend Checking Account, or a Rewards Checking Account.

When we honor overdraft items, you must deposit sufficient funds to cover the overdraft(s) and any applicable fees immediately, but in no case more than thirty (30) days from the date of any notice sent to you. If you fail to cover the total overdraft amount within thirty (30) days, we may pursue all collection options available to us. We may, but are not obligated to, transfer funds from your other accounts with us to cover the overdraft.

For all terms and conditions, see our Disclosure of Account Information & Membership Agreement.

Overdraft Service: At our discretion, we may authorize funds to be transferred from your designated account(s) if you don’t have sufficient funds in your checking account.

Other restrictions, terms, and conditions may apply. Membership is required.