Exclusive Partner Offer

Workplace Benefits Banking1

A program designed to provide exclusive discounts and services to the employees of our most trusted partners.

Up to $3002 can be yours!

As an employee of one of our valued partners, we are proud to offer you exclusive discounts and promotions to help you achieve financial success. As your primary financial institution, you are qualified to receive our exclusive Benefits Banking Package which includes products and services like Inspired Checking, Low Rate Auto Loans, Visa® Credit Cards, High-Yield Term and IRA Certificates and more.

-

$100 - When you open an Inspired Checking Account

-

$100 - When you take our and/or refinance an Auto Loan

-

$100 - When you open a Visa® Platinum or Rewards Credit Card

-

$300 EXTRA CASH IN YOUR POCKET

The Wheelhouse Difference

Wheelhouse Credit Union has been serving San Diegans since 1934 providing value, convenience and highly personalized service to Members living and working in our community. With a bold commitment to sustainability and dedication to causes that improve the life of all San Diegans, our team is committed to leaving San Diego better than we found it.

Inspired Checking3

High yield checking with no monthly minimum balance

Earn up to 3.00% APY* on your everyday Inspired Checking account balance by simply making 20 Debit Card purchase transactions per month, which means your deposits grow over time. Qualifying transactions can be made online, in-person, and more – an easy way to put your money to work with no extra effort. Plus, Wheelhouse debit cards earn Debit Rewards on every signature-based transaction! Redeem your reward points for CASH BACK, gift cards, travel, etc.

Auto Loans4

Be in the Driver’s Seat

We’ll make it easy for you to buy a car or refinance an existing loan at a lower rate. Wheelhouse Credit Union is known for our great rates. We offer flexible terms and a smooth and easy process, so you can get off the lot and out on the road as quickly as possible.

- Competitive rates

- Easy pre-approval process

- No payments for 90 days

- Easy online payments

- Generous loan amounts and flexible terms

- Quick refinancing of an existing auto loan at a lower rate

Credit Cards5

Visa® Platinum Credit Card

Our Visa® Platinum Credit Card has no annual fee, a competitive interest rate based on your credit score, and security features that offer peace of mind.

Visa® Platinum Rewards Credit Card

Our Visa® Platinum Rewards Credit Card offers all of the same great benefits as our Platinum Credit Card, and you’ll also earn reward points for every dollar spent on purchases. Redeem them online for hundreds of amazing rewards, including:

- Merchandise

- Travel and experiences

- Live concerts, theme parks and sports events

- Gift cards

- Cash back

- Charitable donations

Certificates

Our certificates are the perfect way to set aside savings while earning a higher rate than a Regular Savings Account. Whether you choose a 3-month or 5-year certificate, or something in between, you’ll enjoy an impressive return on your investment.

HELOCs

Your home has value, and with a Home Equity Line of Credit you can use that equity to pay for home renovations, remodel your kitchen and other large purchases.

Financial Education

Offer on-site or virtual workshops on a variety of topics hosted by a dedicated representative. Additionally, access a huge library of free learning tools covering topics ranging from budgeting, savings, debt management and more.

How does your Bank Compare?

It’s time to unlock the full potential of your money, compare the cost of banking somewhere else.

Rates effective as of 09/09/2024 and are subject to change without notice. Sources include Bank of America, Citibank, Chase and Wells Fargo.

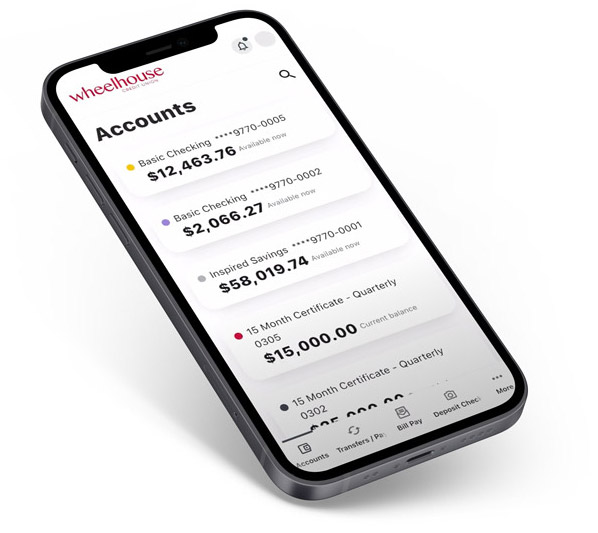

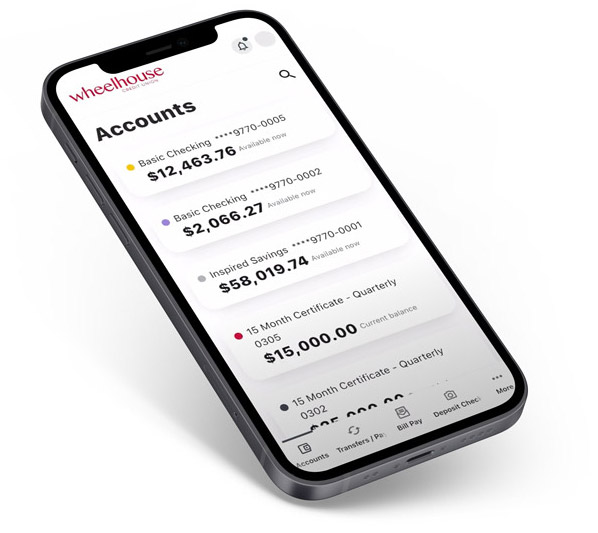

Digital Banking Technology

We want to make banking as simple and convenient as possible. That’s why we continually innovate to provide digital tools to help you manage your finances during your busy life.

-

Mobile Deposit

Deposit checks in just a few taps using your smartphone.

-

Quick Login and TouchID

Conveniently access your accounts on-the-go using our mobile app.

-

Send and Receive Money with Zelle®

A fast, safe and free way to send money to friends, family and other people you trust, regardless of where they bank.

-

Digital Wallet

Enjoy the convenience of having your cards digitally stored on your mobile device. Simply add your Wheelhouse Visa® Credit Card and Debit Card to any digital wallet app for easy access.

Wills & Trusts Planning

Members are eligible for discounted Will and Trust planning.

Discounted Movie Tickets

Members receive access to discounted Regal movie tickets. Tickets available in Wheelhouse branches, while supplies last.

Credit Union Travel

Members get free access to unbeatable rates at 1.2 million hotels worldwide, enjoy flexible bookings, and earn rewards when using your Wheelhouse Visa® Debit Credit Card to book.

Wheelhouse is Committed To Giving Back

Our team is actively involved in the community throughout the year, and we’re proud to support a wide variety of organizations and efforts that have a positive impact on our beautiful City.

Disclosures

*APY = Annual Percentage Yield

Participating Partners

1WorkPlace Benefits Banking (WBB) is available to employees of Wheelhouse® Credit Union’s partner employers (Participating Partners). For eligibility information or if you are interested in becoming a partner employer, please visit https://wheelhousecreditunion.formstack.com/forms/workplace_banking.

2Banking Incentives (Bonus Offers) are valid only for current employees of Wheelhouse Participating Partners; current paystub is required to be eligible to apply. Other restrictions may apply.

Checking Bonus Offer is not available to existing Wheelhouse checking members. Auto Loan (purchase or refinance) and Credit Card Bonus Offer are not available to existing Wheelhouse members who have current auto loans or credit cards (Collectively, Offers).

Bonus Offers are not available to those whose accounts have been closed within 90 days or closed with a negative balance within the last 3 years. You can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. Coupon is good for one-time use.

To receive any of the above Banking Incentive Offers, the enrolled account must not be closed or restricted at the time of payout. Eligibility may be limited based on account ownership.

To receive the Checking Bonus Offer: 1) open a new Wheelhouse Checking account, which is subject to approval; AND 2) have your direct deposit made to this account within 90 days of coupon enrollment. Your direct deposit needs to be an electronic deposit of your paycheck, pension, or government benefits (such as Social Security) from your employer or the government. Person-to-Person payments (such as Zelle®) are not considered direct deposit. Micro deposits do not qualify as a direct deposit for the bonus. Micro-deposits are small deposits, typically less than $1, that are sent to your account to verify it is the correct account. After you have completed all the above checking requirements and the account has been open for 120 days, the bonus will be deposited into your new Checking account the following day. within 15 days. Membership required.

Auto Loan Purchase or Refinance Bonus Offer You will qualify for $300 total bonus cash rewards if you 1) apply for an Auto Loan Purchase or Refinance (2017 or newer), which is subject to credit approval, and 2) meet all loan requirements. Offer is valid for current employees of Wheelhouse® Participating Partners only.

To receive the Auto Loan Purchase or Refinance Bonus Offer: Membership required. Once the loan requirements have been met, the bonus will automatically be deposited to the Member’s primary share account. The value of this reward may constitute taxable income to you.

Credit Card Bonus Offer: You will qualify for $300 total bonus cash rewards if you 1) Open a new Wheelhouse® Credit Card, which is subject to credit approval; and 2) if you use your new credit card account to make any combination of purchase transactions totaling at least $1,000 (excluding any fees) that post to your account within 120 days of the account open date. Returns, credits, and adjustments to this card will be deducted from purchases, even if this card was not the original payment method. Cash Advances and Balance Transfers are not considered purchases and do not apply for purposes of this offer. Limit 1 bonus cash rewards offer per new account. This one-time promotion is limited to current employees of Wheelhouse Participating Partners only and who become new members opening a new account in response to this offer and will not apply to requests to convert existing accounts. Your account must be open with active charging privileges to receive this offer. Other advertised promotional bonus cash reward offers can vary from this promotion and may not be substituted.

To receive the Credit Card Bonus Offer: Membership required. Once the credit card account requirements have been met, the bonus will automatically be deposited to the Member’s primary share account. The value of this reward may constitute taxable income to you. Bonuses are considered interest, and you may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates, provide tax advice.

Bonuses may be considered taxable as income, and you may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates, provide tax advice.

3Inspired Checking

To receive the APY of 3.00%, you must make a minimum of 20 qualifying purchase transactions using your Wheelhouse® Visa® debit card associated with an Inspired Checking account per calendar month and/or maintain an average daily balance of $75,000 or higher. No minimum balance is required to earn dividends. Inspired Checking is a variable rate account. The APY may change after account opening. Fees could reduce earnings on the account.

Inspired Checking requires the following within 90 days of account opening: initial minimum deposit of $10, at least $450 in recurring monthly direct deposits, active digital banking registration, and enrollment in eStatements. If requirements are not met and maintained, the account will be converted to a Basic Checking account, which may be subject to different terms, conditions, and restrictions. Membership required.

Wheelhouse Online Bill Pay: You must enroll in Wheelhouse online banking and activate Online Bill Pay. Certain restrictions may apply.

Wheelhouse Mobile App is available for select mobile devices. Enroll in Wheelhouse Online Banking or on the Wheelhouse Mobile app. Deposits made through the Wheelhouse Mobile app are subject to deposit limits and funds are typically available by next business day. Deposit limits may change at any time. Other restrictions apply. See Account Agreement for eligible mobile devices, limitations, terms, conditions, and details. Message and data rates may apply.

Zelle® requires a U.S. checking account. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Contact a Team Member for further information. Other terms and conditions may apply.

©2025 Wheelhouse Credit Union | Federally insured by NCUA

4Auto Loans

All loans subject to credit and collateral approval. Contact a Team Member for further information. Membership required.

With our payment deferral option, you can postpone payments for up to 90 days, based on creditworthiness. Interest will continue to accrue during this period.

5Credit Card Terms & Conditions

Visa is a registered trademark. ©2025 Visa. All Rights Reserved.

APR = Annual Percentage Rate. Certain restrictions and fee(s) may apply. All loans are subject to credit approval. The APR will vary with the market based on the Prime Rate. Additionally, fees may reduce earnings on the account. See Terms & Conditions for details. Membership and credit are subject to approval. A one-time $1 membership fee and savings account are required. Restrictions may apply. Available for new accounts only. This offer may be used once only by the name herein and is not transferable.